AI-Powered Document Automation: Streamline Your Workflow

Transform your document processes with AI-powered automation, designed to streamline workflows, reduce manual tasks, and increase efficiency. With advanced data extraction and classification, our intelligent automation solutions help businesses save time, minimize errors, and enhance productivity, allowing teams to focus on higher-value tasks.

Why Documents Automation?

In today's fast-paced business environment, managing large volumes of documents manually can be time-consuming, error-prone, and inefficient. AI-powered document automation offers a solution by streamlining these processes, allowing businesses to handle documents more quickly and accurately. By leveraging intelligent automation, organizations can free up resources, reduce operational costs, and enhance overall productivity. Here’s why document automation is essential for modern businesses.

Increased Efficiency

Documents Automation drastically reduces the time spent on manual data entry, enabling teams to process large volumes of documents quickly and accurately.

Cost Savings

Automating document processing eliminates the need for extensive manual labor, significantly reducing operational costs associated with document management.

Improved Accuracy

AI-powered validation ensures that extracted data is error-free, minimizing the risk of mistakes often associated with manual processes.

Compliance and Security

Documents Automation ensures that all data is handled in compliance with industry regulations, offering secure storage and processing for sensitive business information.

Scalable Solution

Whether your business processes a few hundred or thousands of documents daily, Documents Automation is scalable to meet your growing needs.

Real-Time Analytics

Gain insights into document processing through real-time analytics, allowing businesses to track and optimize workflows more effectively.

Ready to transform your business with Ray Business Technologies ?

Unlock the Future with AI Innovations

Stay at the forefront with our groundbreaking AI innovations, transforming industries and unlocking endless possibilities. From Conversational AI to intelligent automation, discover how our latest advancements can propel your business to new heights and open doors to future growth.

Document Automation Use Cases

Document automation simplifies workflows, reduces manual tasks, and improves accuracy. By using AI, businesses can streamline processes, ensure compliance, and free up resources for more important tasks. Here are key use cases where document automation drives impact.

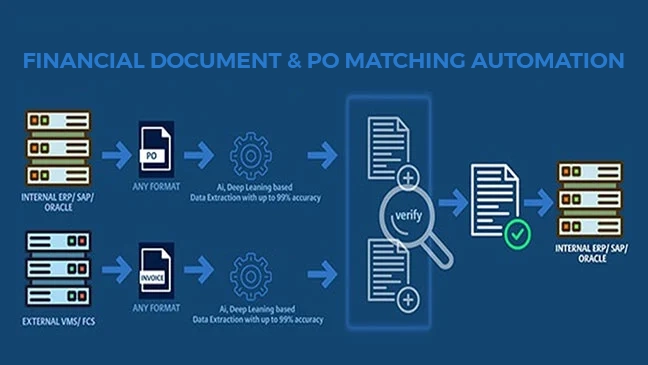

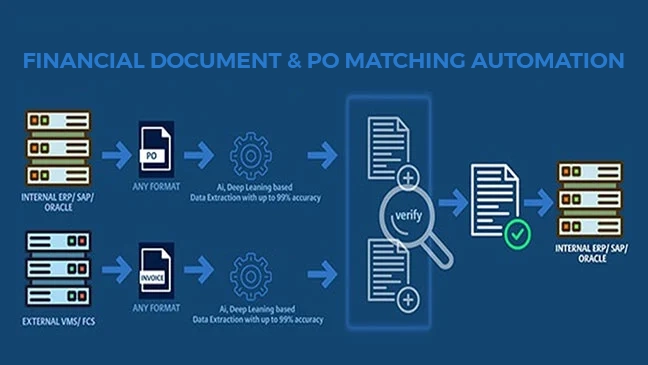

In the financial sector, managing large volumes of documents like invoices, purchase orders, and financial statements is a time-consuming task that often involves repetitive manual processes. Document automation uses AI to extract relevant data from these documents, validate them against predefined business rules, and process them efficiently. This automation reduces the need for human intervention, minimizing errors such as incorrect data entries or missed payments, and ensures that the documents are processed quickly, leading to faster approval cycles. Automating financial documents improves compliance by ensuring audit-ready processing and real-time tracking. This reduces the risk of penalties, enhances internal management, and boosts stakeholder confidence with timely, accurate financial reporting.

_1.webp)

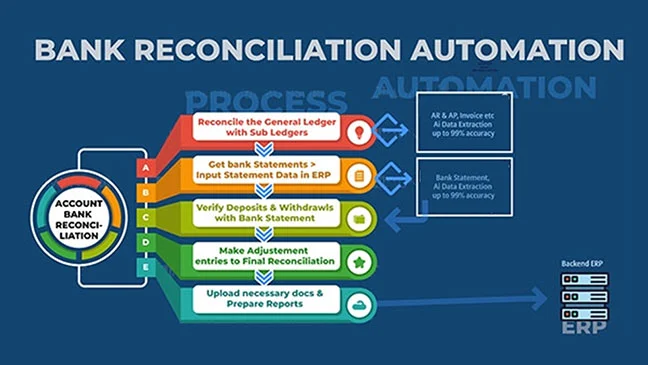

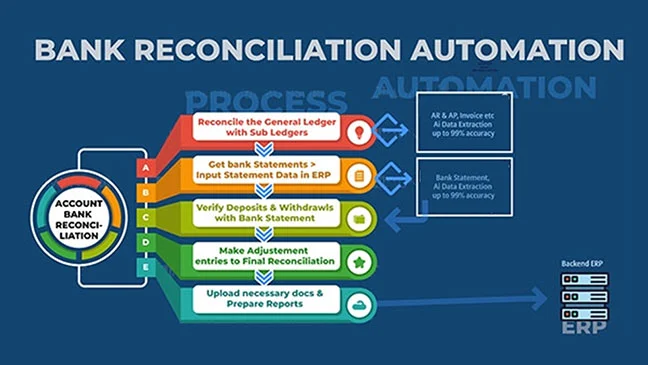

Manually reconciling bank transactions with internal financial records can be a labor-intensive and error-prone process. Bank reconciliation automation simplifies this by automatically comparing bank statements with internal data, identifying discrepancies, and reconciling them in real time. This ensures that mismatches are flagged early, reducing the likelihood of errors and the need for time-consuming manual checks. Automating bank reconciliation enhances financial transparency and accuracy, freeing finance teams to focus on higher-value tasks like trend analysis and cash flow improvement. It creates a streamlined, scalable system that maintains accuracy as transaction volumes grow.

Preparing annual financial reports is often a complex, resource-intensive process that involves gathering data from multiple departments and systems. Document automation simplifies this process by collecting, consolidating, and validating financial data from various sources. This ensures that the data used in the final report is accurate and consistent, reducing the need for manual intervention and minimizing the risk of errors in the final report. Automating annual reporting shifts finance teams from data collection to analysis and strategy, enabling better decision-making with accurate, timely insights. It ensures compliance with standards and deadlines, reducing penalties and boosting stakeholder confidence in the company's financial health.

In the financial sector, managing large volumes of documents like invoices, purchase orders, and financial statements is a time-consuming task that often involves repetitive manual processes. Document automation uses AI to extract relevant data from these documents, validate them against predefined business rules, and process them efficiently. This automation reduces the need for human intervention, minimizing errors such as incorrect data entries or missed payments, and ensures that the documents are processed quickly, leading to faster approval cycles. Automating financial documents improves compliance by ensuring audit-ready processing and real-time tracking. This reduces the risk of penalties, enhances internal management, and boosts stakeholder confidence with timely, accurate financial reporting.

_1.webp)

Manually reconciling bank transactions with internal financial records can be a labor-intensive and error-prone process. Bank reconciliation automation simplifies this by automatically comparing bank statements with internal data, identifying discrepancies, and reconciling them in real time. This ensures that mismatches are flagged early, reducing the likelihood of errors and the need for time-consuming manual checks. Automating bank reconciliation enhances financial transparency and accuracy, freeing finance teams to focus on higher-value tasks like trend analysis and cash flow improvement. It creates a streamlined, scalable system that maintains accuracy as transaction volumes grow.

Preparing annual financial reports is often a complex, resource-intensive process that involves gathering data from multiple departments and systems. Document automation simplifies this process by collecting, consolidating, and validating financial data from various sources. This ensures that the data used in the final report is accurate and consistent, reducing the need for manual intervention and minimizing the risk of errors in the final report. Automating annual reporting shifts finance teams from data collection to analysis and strategy, enabling better decision-making with accurate, timely insights. It ensures compliance with standards and deadlines, reducing penalties and boosting stakeholder confidence in the company's financial health.

Top 3 Benefits

Document automation boosts efficiency by reducing manual tasks, improves accuracy by minimizing errors, and enhances compliance with secure, audit-ready processes. These benefits save time, cut costs, and increase productivity.

-

Time Savings

Documents Automation significantly cuts down the time required for document processing, allowing teams to focus on strategic business activities rather than manual data entry.

-

Enhanced Accuracy and Compliance

AI ensures that data is extracted and validated with precision, reducing the risk of human error and ensuring compliance with legal and financial regulations.

.webp)

-

Cost Efficiency

By automating the document workflow, businesses can reduce labor costs associated with manual document management and allocate resources to more critical areas of the business.

Transform Your Business with Document Automation

Implementing Documents Automation can transform the way your business manages its document workflows. With the ability to process large volumes of documents quickly, accurately, and securely, your organization can operate more efficiently while reducing operational costs. Whether you’re in finance, banking, or any other document-heavy industry, Documents Automation ensures that your processes are streamlined, compliant, and scalable for growth.