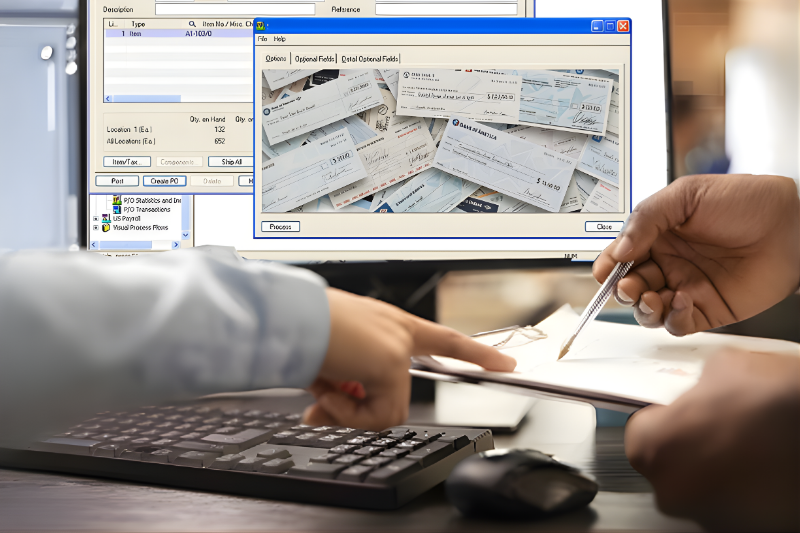

Process & Track Bank Checks Securely with Ai Powered, on-premise Solution

Bank Checks Processing System automates the entire checks lifecycle using AI and RPA. From scanning and data extraction to truncation, audit trails and ERP reconciliation, it reduces errors, ensures compliance and delivers bank-grade security at enterprise scale.

.png?ext=.png)

Benefits of Our Bank Checks Processing System

AIUN delivers enterprise bank checks automation that is faster, more accurate and compliance-ready. By combining AI, RPA and ERP integration, it reduces costs, mitigates risk and gives finance leaders full control and visibility across the bank checks lifecycle.

AI-powered bank checks processing minimizes errors through automated validation, duplicate detection and exception handling. Built-in controls ensure every checks follows standardized, policy-driven workflows with complete audit trails.

AIUN supports compliance-ready checks automation with role-based access, approvals and traceability. Finance and compliance teams stay audit-ready with end-to-end visibility and documented controls for every checks action.

AIUN integrates seamlessly with SAP, Microsoft Dynamics 365, Oracle and more. ERP-integrated checks management ensures clean postings, faster closures and fewer mismatches across finance systems.

Designed for enterprise checks automation, AIUN scales securely across business units and geographies. API-based connectivity and configurable workflows support growth without rework or system fragmentation.

AIUN accelerates checks handling by eliminating manual entry and handoffs. Intelligent checks processing shortens cycle times, improves throughput and enables teams to process higher volumes without increasing headcount or operational risk.

By automating capture, validation and workflow routing, AIUN reduces bottlenecks across finance operations. Enterprises gain faster checks clearing, quicker reconciliation and predictable processing timelines across locations and teams.

AI-powered bank checks processing minimizes errors through automated validation, duplicate detection and exception handling. Built-in controls ensure every checks follows standardized, policy-driven workflows with complete audit trails.

AIUN supports compliance-ready checks automation with role-based access, approvals and traceability. Finance and compliance teams stay audit-ready with end-to-end visibility and documented controls for every checks action.

AIUN integrates seamlessly with SAP, Microsoft Dynamics 365, Oracle and more. ERP-integrated checks management ensures clean postings, faster closures and fewer mismatches across finance systems.

Designed for enterprise checks automation, AIUN scales securely across business units and geographies. API-based connectivity and configurable workflows support growth without rework or system fragmentation.

AIUN accelerates checks handling by eliminating manual entry and handoffs. Intelligent checks processing shortens cycle times, improves throughput and enables teams to process higher volumes without increasing headcount or operational risk.

By automating capture, validation and workflow routing, AIUN reduces bottlenecks across finance operations. Enterprises gain faster checks clearing, quicker reconciliation and predictable processing timelines across locations and teams.

Features of Bank Checks Processing System

AIUN combines intelligent automation, bank checks truncation and ERP integration into one secure platform. These features standardize processing, improve visibility and ensure enterprises achieve accuracy, compliance and scalability without manual overhead.

- AI Data Extraction & Validation

- Automatically captures bank checks data with high accuracy, reducing manual entry and preventing processing errors.

- Audit Trail & Tracking

- Maintains complete logs for every bank checks action, supporting audits and compliance requirements.

- Bank-Grade Security Controls

- Implements encryption, access controls and approvals to protect sensitive financial data.

- Bank Checks Truncation Automation

- Digitizes bank checks securely for faster clearing while maintaining compliance and standardized processing.

- ERP-Integrated Reconciliation

- Synchronizes bank checks data with SAP and Dynamics 365 for faster reconciliation and clean books.

- Rule-Based Workflow Routing

- Routes bank checks by amount, account, location and risk for controlled, policy-driven approvals.

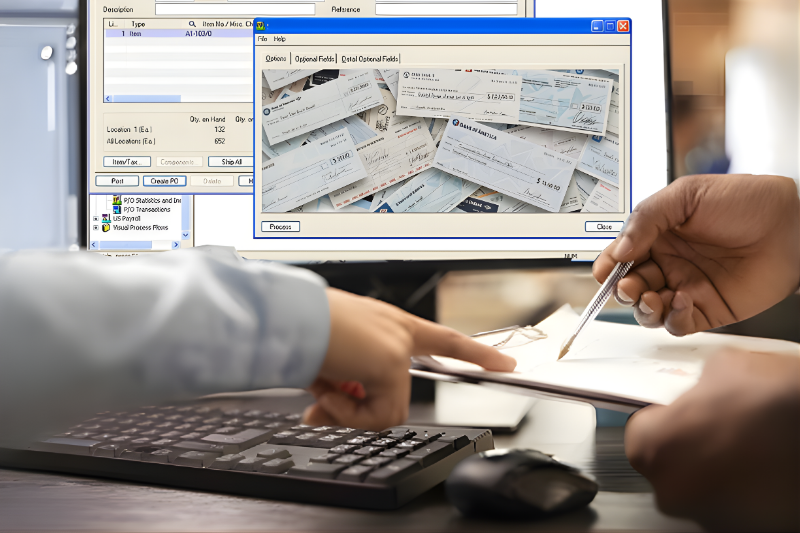

Our Expertise in Bank Checks Processing System

With deep expertise in enterprise automation, ERP integration and compliance, we deliver AIUN as a secure, audit-ready checks processing platform that meets the expectations of CIOs, CFOs and compliance leaders.

-

Enterprise Bank Checks Automation Design

We architect automated checks management systems tailored for high-volume enterprises. Our expertise ensures scalable, reliable and future-ready bank checks automation aligned to business and compliance needs.

.png?ext=.png)

-

ERP & Finance System Integration

Our team specializes in bank checks automation for SAP and Microsoft Dynamics 365. We ensure seamless ERP integration, accurate postings and faster financial closures with minimal disruption.

_2.png?ext=.png)

-

Security, Compliance & Governance

We embed bank-grade checks security and compliance-ready controls into every deployment. From audit trails to role-based access, governance is built into the core of AIUN.

.png?ext=.png)

Built for Modern Enterprise Finance

AIUN is designed to solve real-world bank checks processing challenges faced by enterprise finance teams. It replaces manual processes with intelligent automation while ensuring security, compliance and ERP alignment at every step.

Accuracy at Scale

Reduces errors and exceptions through intelligent validation and standardized processing rules.

Automation First

Eliminates manual bank checks handling with AI-powered capture, validation and workflow automation.

Security by Design

Protects bank checks data with bank-grade security, approvals and full audit visibility.

Take Help of Our Customer Success Team

Our experts guide you through assessment, deployment and optimization to ensure successful bank checks automation.

Why Choose Bank Checks Processing System

AIUN is a secure, enterprise-grade bank checks automation software that reduces costs, mitigates risk and integrates seamlessly with ERP systems to modernize checks processing.

AI-Driven Accuracy & Exception Handling

Uses AI to extract bank checks data with high accuracy, automatically flag exceptions and reduce manual intervention and processing errors.

Compliance & Audit Confidence

Delivers audit-ready bank checks processing with full traceability and governance controls.

Enterprise-Ready Automation

Built to handle high bank checks volumes with consistent performance, accuracy and scalability.

ERP-Native Integration

Connects directly with SAP and Dynamics 365 for faster reconciliation and closure.

FAQ's

Q1. What is AI-powered bank checks processing?

AI-powered bank checks processing uses artificial intelligence to automatically scan, extract and validate checks data. AIUN eliminates manual entry, reduces errors, accelerates checks clearing and ensures audit-ready processing with complete traceability.

Q2. How does AIUN automate bank checks processing end to end?

AIUN automates the entire checks lifecycle—from scanning or batch uploads to AI data extraction, validation, workflow routing, truncation, ERP synchronization and reconciliation—ensuring faster processing, higher accuracy and compliance-ready operations.

Q3. Can AIUN replace manual bank checks processing completely?

Yes. AIUN is designed to fully replace manual checks processing by using intelligent checks processing and RPA. It eliminates data entry, manual approvals and spreadsheet tracking while maintaining full visibility and control.

Q4. Does AIUN support bank checks truncation automation?

Yes. AIUN supports secure bank checks truncation automation, converting physical checks into digital formats for faster clearing while maintaining tracking, audit logs and compliance controls throughout the process.

Q5. Is AIUN an ERP-ready bank checks automation platform?

Absolutely. AIUN integrates seamlessly with SAP, Microsoft Dynamics 365, Oracle and other ERP systems. This ERP-integrated bank checks management ensures accurate postings, faster reconciliation and clean financial closures.

Q6. How does AIUN ensure accuracy in bank checks processing?

AIUN uses AI-powered validation, duplicate detection, exception handling and rule-based workflows to reduce bank checks processing errors and ensure standardized, high-accuracy processing across all locations and teams.

Q7. Is AIUN suitable for large enterprises and banks?

Yes. AIUN is built for enterprise bank checks automation and high-volume environments. It supports multi-entity operations, role-based access, scalable workflows and bank-grade security for enterprises and financial institutions.

Q8. How does AIUN handle security and compliance requirements?

AIUN provides bank-grade checks security with encryption, role-based access, approval workflows and complete audit trails. It is a compliance-ready checks automation platform designed to meet internal and regulatory audit requirements.

Q9. Can AIUN reduce bank checks processing costs?

Yes. By eliminating manual work, reducing errors and accelerating reconciliation, AIUN significantly reduces checks processing costs while improving operational efficiency and finance team productivity.

Q10. How long does it take to implement AIUN Bank Checks Processing System?

Implementation timelines vary based on volume and ERP complexity, but most enterprises can go live quickly with minimal disruption. AIUN is designed for rapid deployment and easy integration with existing finance systems.

Q11. Does AIUN support exception handling and approvals?

Yes. AIUN includes intelligent exception handling, rule-based routing and configurable approval workflows to ensure controlled processing for high-value, high-risk, or non-standard checks.

Q12. Can we request a demo or proof of concept (POC)?

Yes. You can book a free checks automation demo or request a checks processing POC to see how AIUN automates checks processing, integrates with your ERP and improves accuracy and compliance.